Client

Bankora App (Concept)

Services

Market Research, Branding, UX, UI

Year

2021

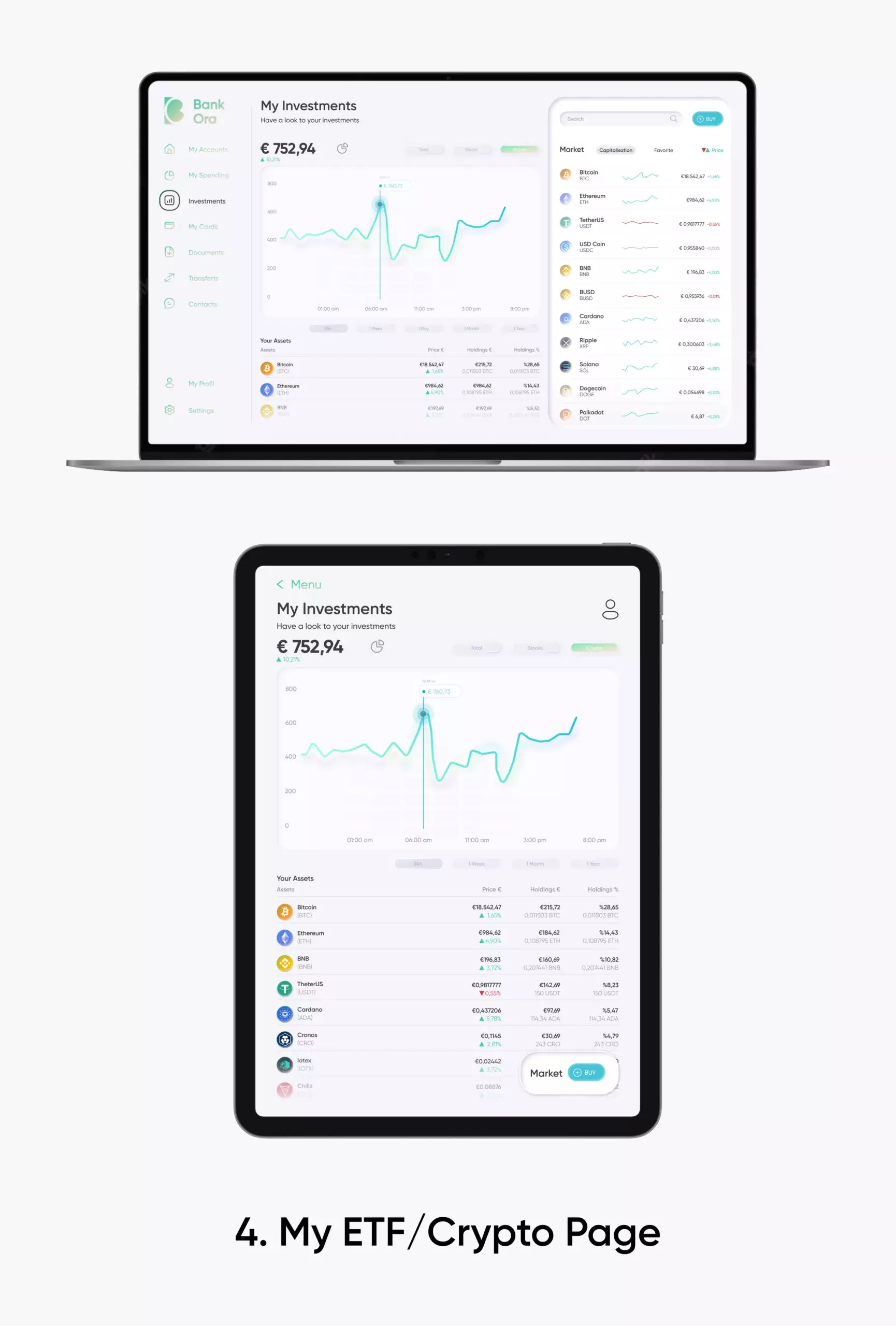

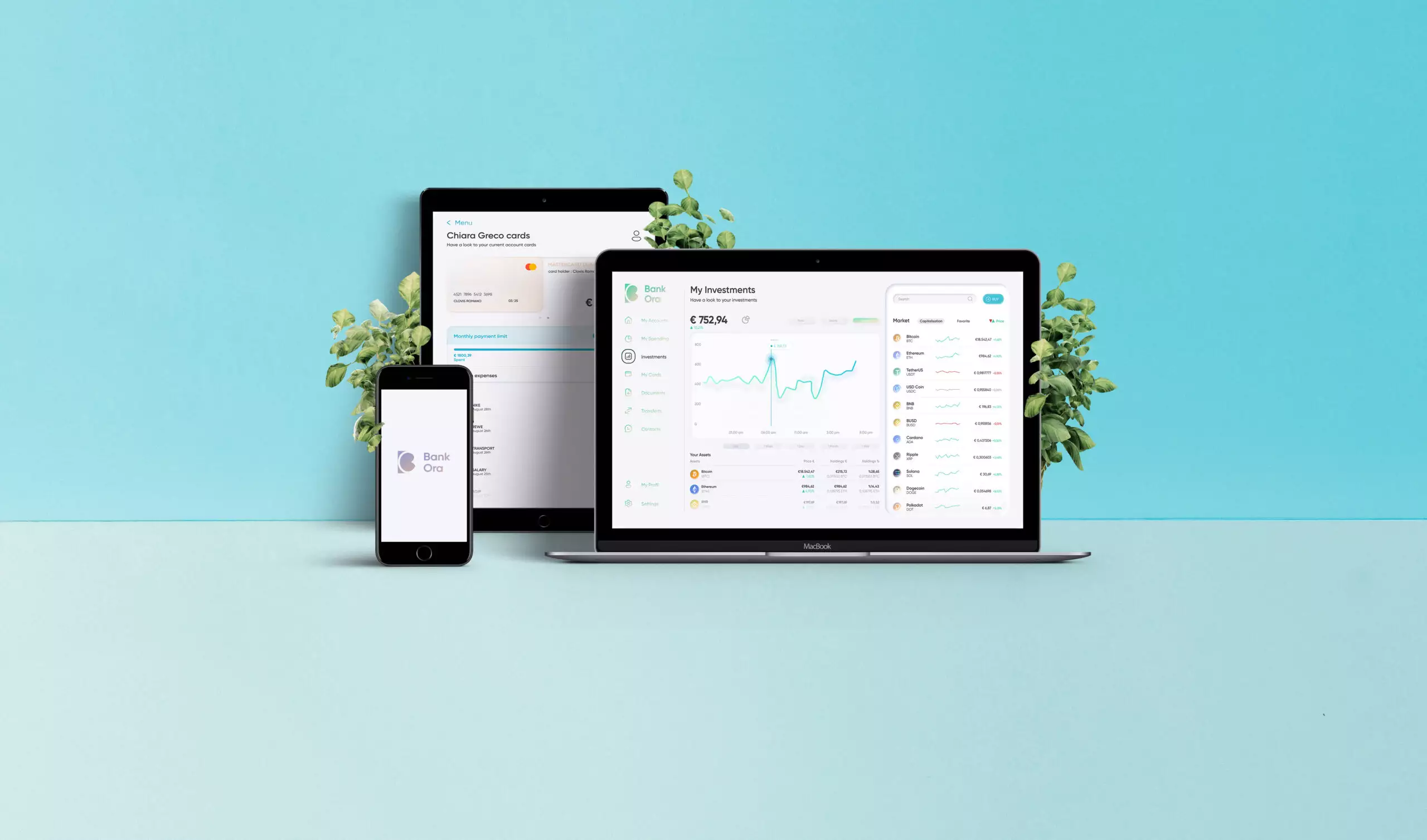

BankOra is a responsive neobank app that empowers users to efficiently manage their bank accounts and invest in ETFs and cryptocurrencies. This application provides a direct and user-friendly interface for users to easily access information about their available funds and assets.

Simplifying Financial Management with Bankora: The Future of Banking and Investments

With the rise of digital technology and banking applications, consulting bank statements has become significantly easier. Moreover, the ability to manage multiple accounts across different banks has become increasingly common. Investing in ETF assets and cryptocurrencies directly from our smartphones has also become more accessible. The gamification of these digital products, combined with user-friendly interfaces, has paved the way for the democratization of financial services.

The Growing Popularity of Financial Investments

In France, 35% of the population invests or expresses an interest in investing in the stock market. Among individuals under 35 years old, this percentage rises to 49%, and for those under 25, it climbs to 58%. Growing enthusiasm is enabling people to educate themselves and gain better control over their finances. As a result, many are feeling more empowered in their financial decisions.

However, as the number of financial applications on our phones has multiplied, users often struggle with navigating through various interfaces. This can make it difficult to keep track of investments and overall net worth. Therefore, a unified solution is essential for simplifying this experience.

Introducing Bankora Concept: A Unified Solution for Financial Management

To address this challenge, the Bankora concept introduces a neobank app that provides a seamless experience for managing bank accounts, as well as investing in selected cryptocurrencies and ETFs. For this project, developed as part of my UI certification, aims to create a prototype that improves how users interact with their finances.

By using Bankora, individuals can quickly access a variety of assets and easily manage both their current and savings accounts. With just a few clicks, users will gain complete control over their financial activities, making it easier than ever to stay on top of their investments and finances.

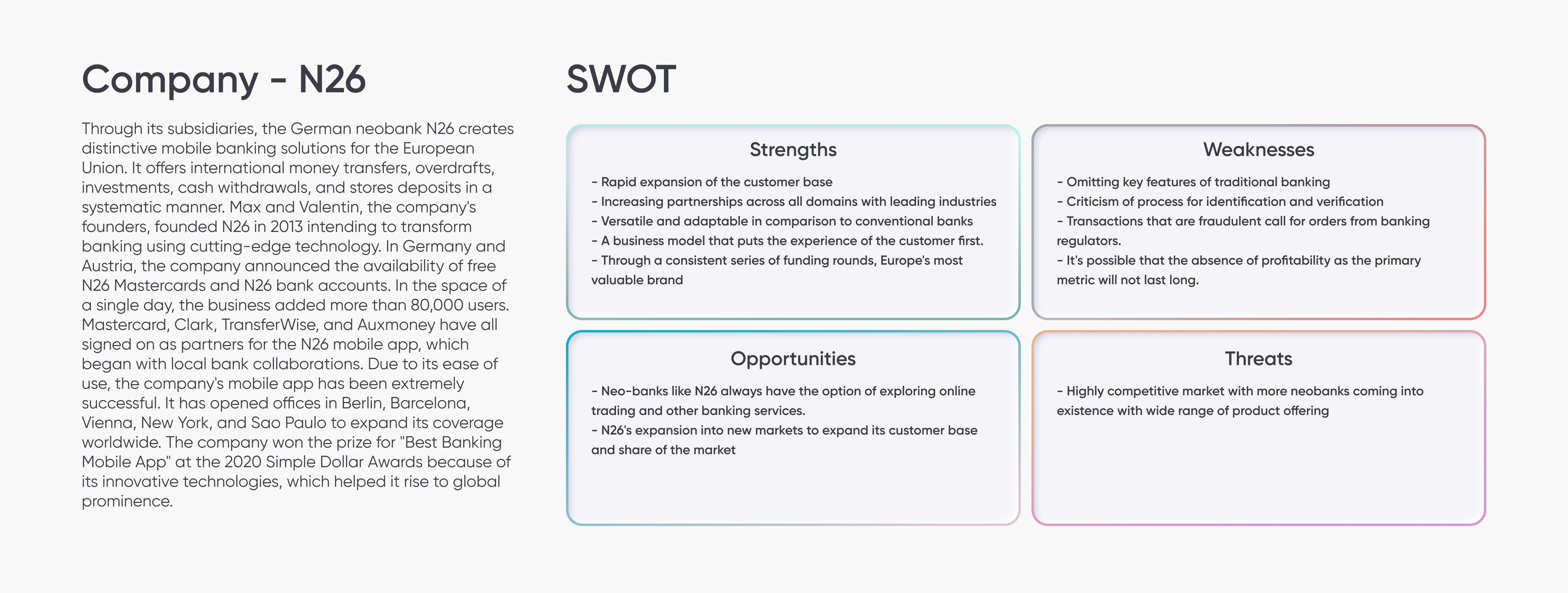

MARKET ANALYSIS

PERSONAS

- AGE: 42

- JOB: LEGAL ADVISOR

- STATUS: MARRIED, 1 CHILDREN

- LOCATION: PARIS

Christine is a legal advisor for two financial firms in Paris. Christine has always been saving and looking after her money. Since she is 30 years old, she also uses her knowledge in the sector where she works to invest in different stocks every month. Married and mother of a little boy. She spends more time with her family and especially in her newly bought apartment (with a mortgage).

- Carrer Oriented

- Strategist

- Extraverted

- Hard Worker

- Work hard, invest well before her retirement

- Raise her son and giving him opportunity for his future

- Build a new activity/business for herself after 50

- No time for leisure

- Bank Morgage to pay

- Difficult to track all her investment without her Excel Sheet

- Getting Healthier

- Make more stock profits

- Buy a new flat in the next 5 years

FAVORITE APPS

- AGE: 26

- JOB: DATA ANALYST

- STATUS: SINGLE

- LOCATION: BERLIN

Jean is a junior data analyst for a startup in Berlin. As a technology enthusiast, he has always been interested in how to make money through the internet and also in crypto-currencies. Very quickly independent, he invested as soon as he could on different platforms and opened different accounts in different banks to better save and prepare his future projects: building is own e-commerce business.

- Emphatic

- Super connected

- Introverted

- Innovative

- Create his own company

- Help people

- Being financially independent and retire earlier

- Don’t see much his friends and family

- Spend to much time on screen

- Too many app to use

- Work on his company

- Continuing investing

FAVORITE APPS

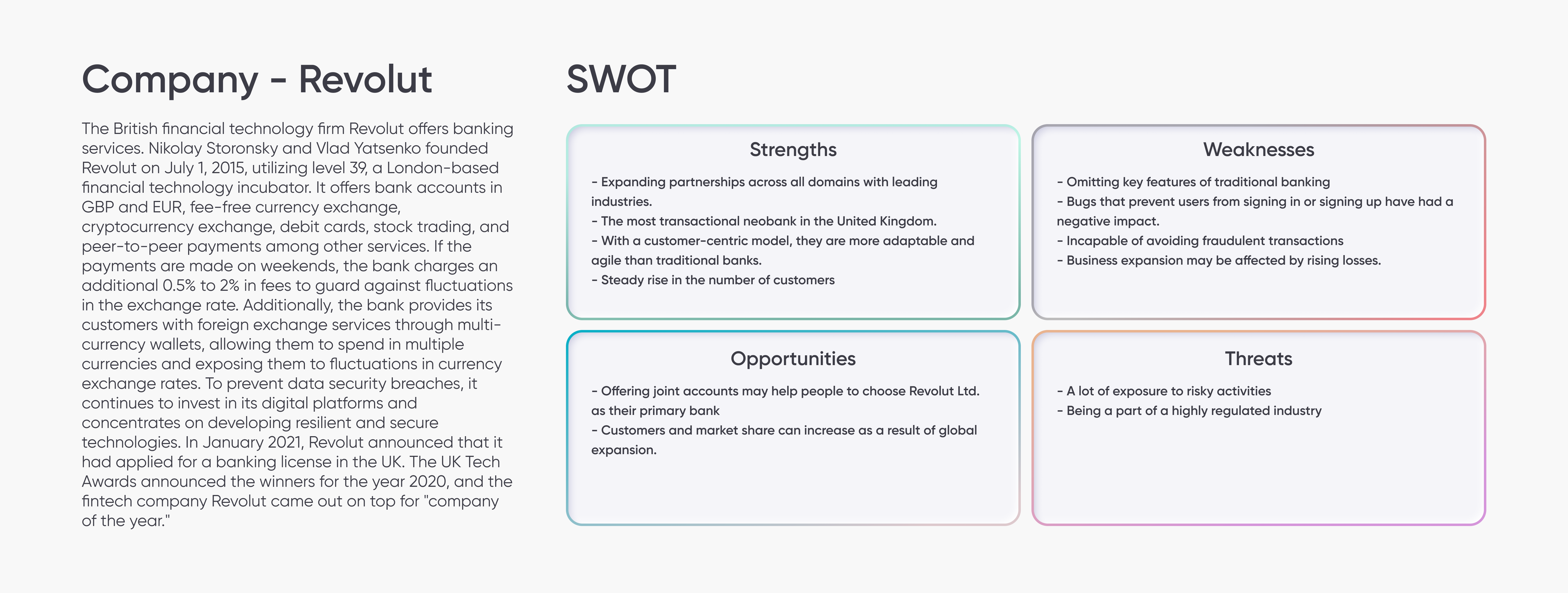

USERFLOW DIAGRAM OVERVIEW

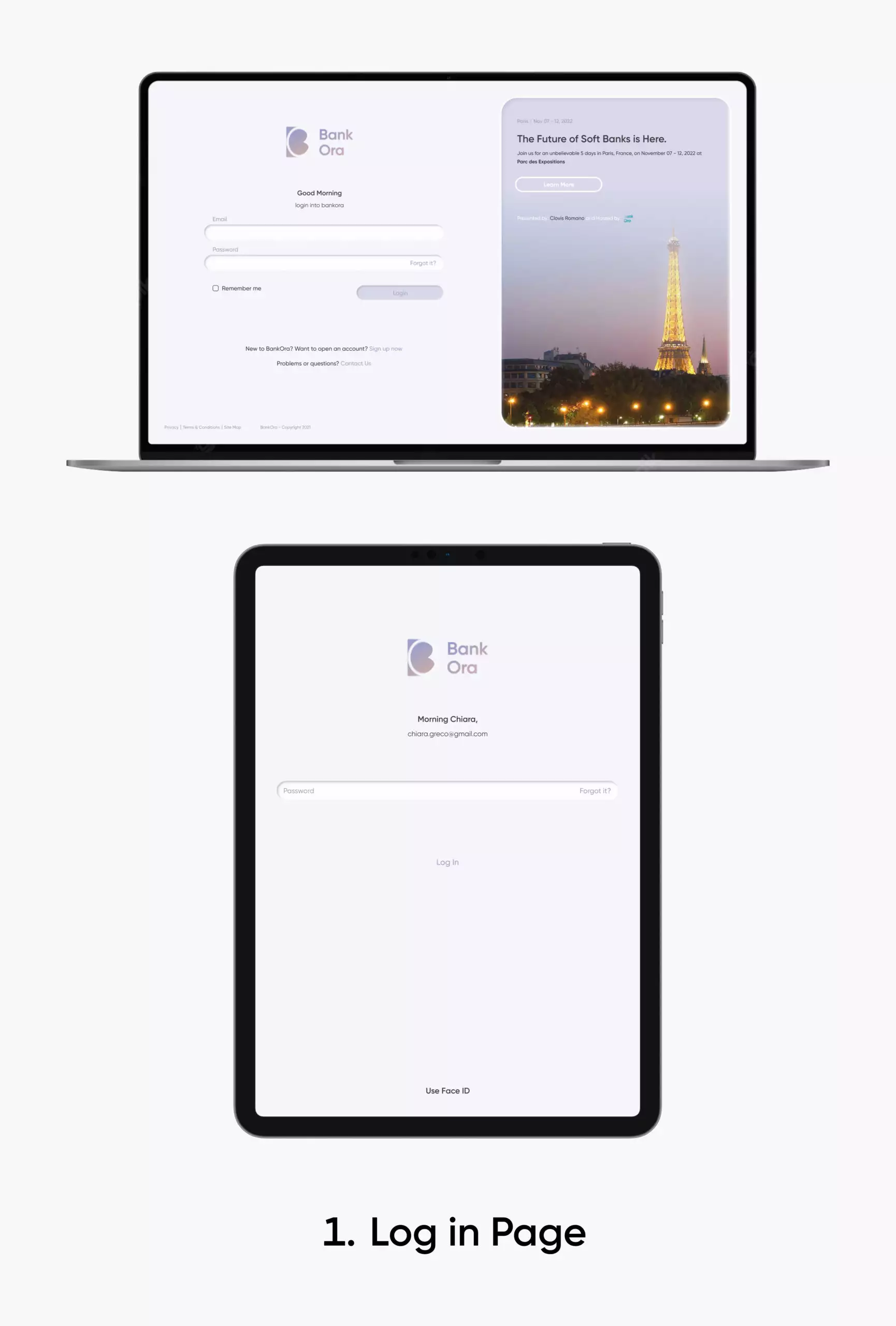

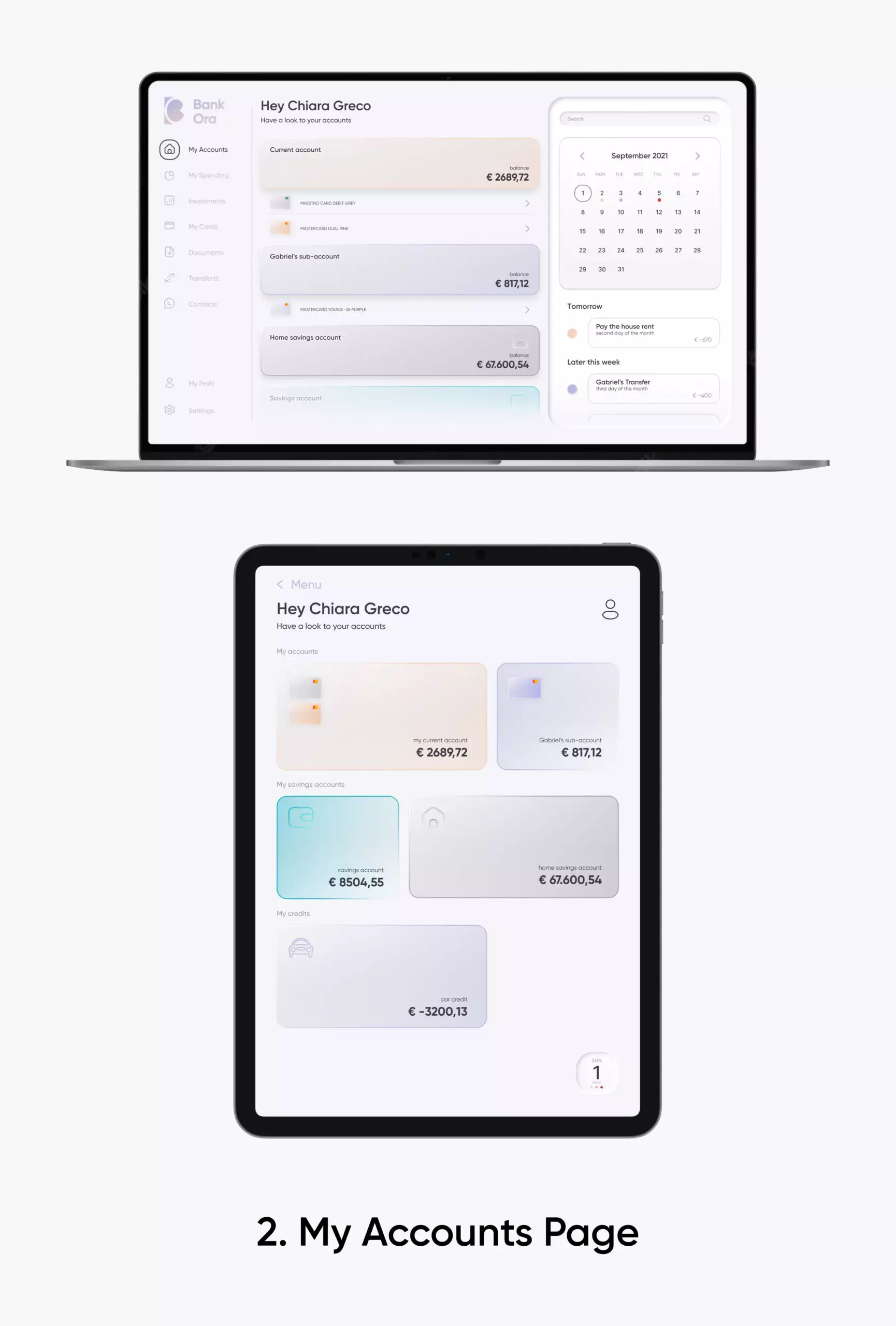

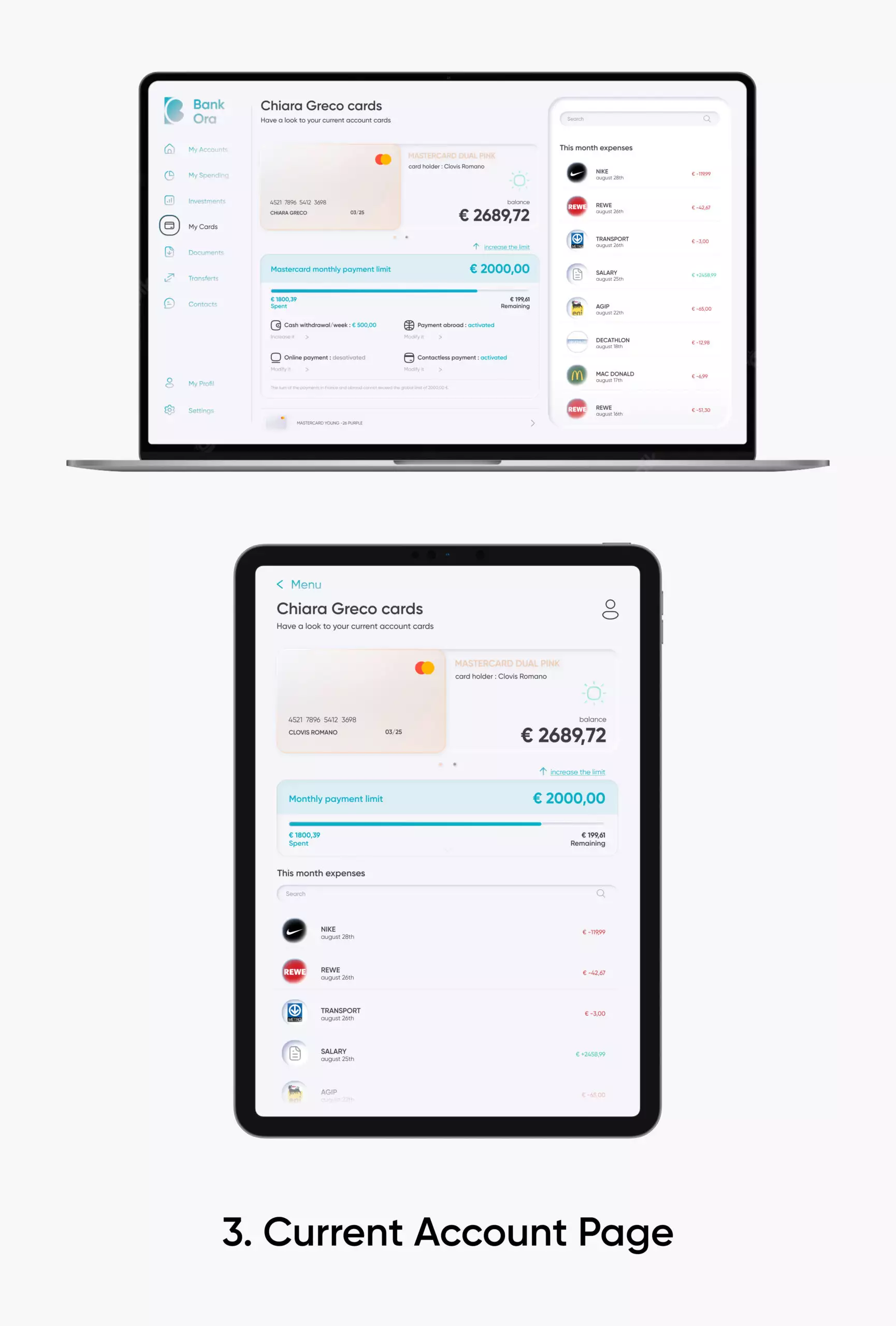

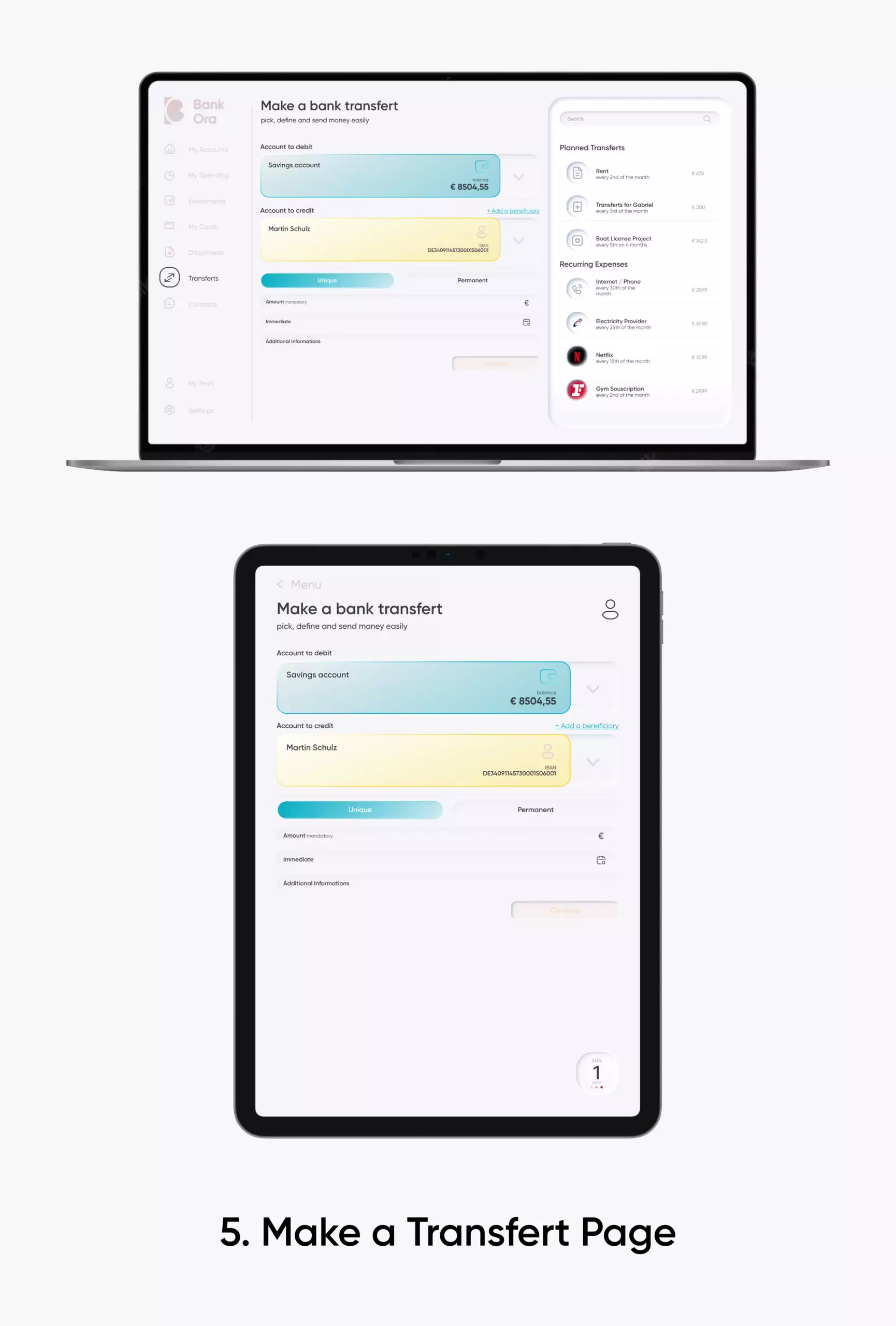

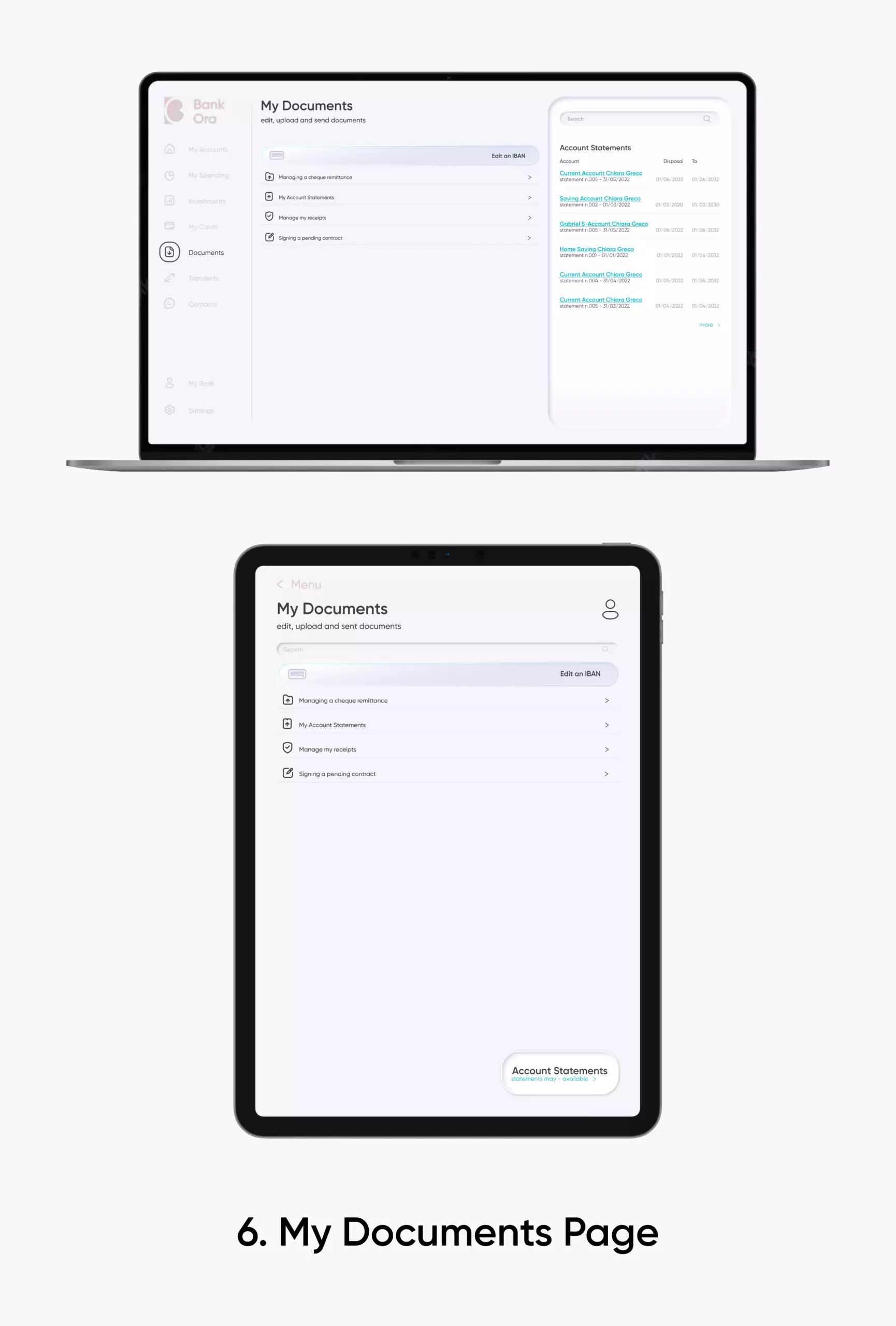

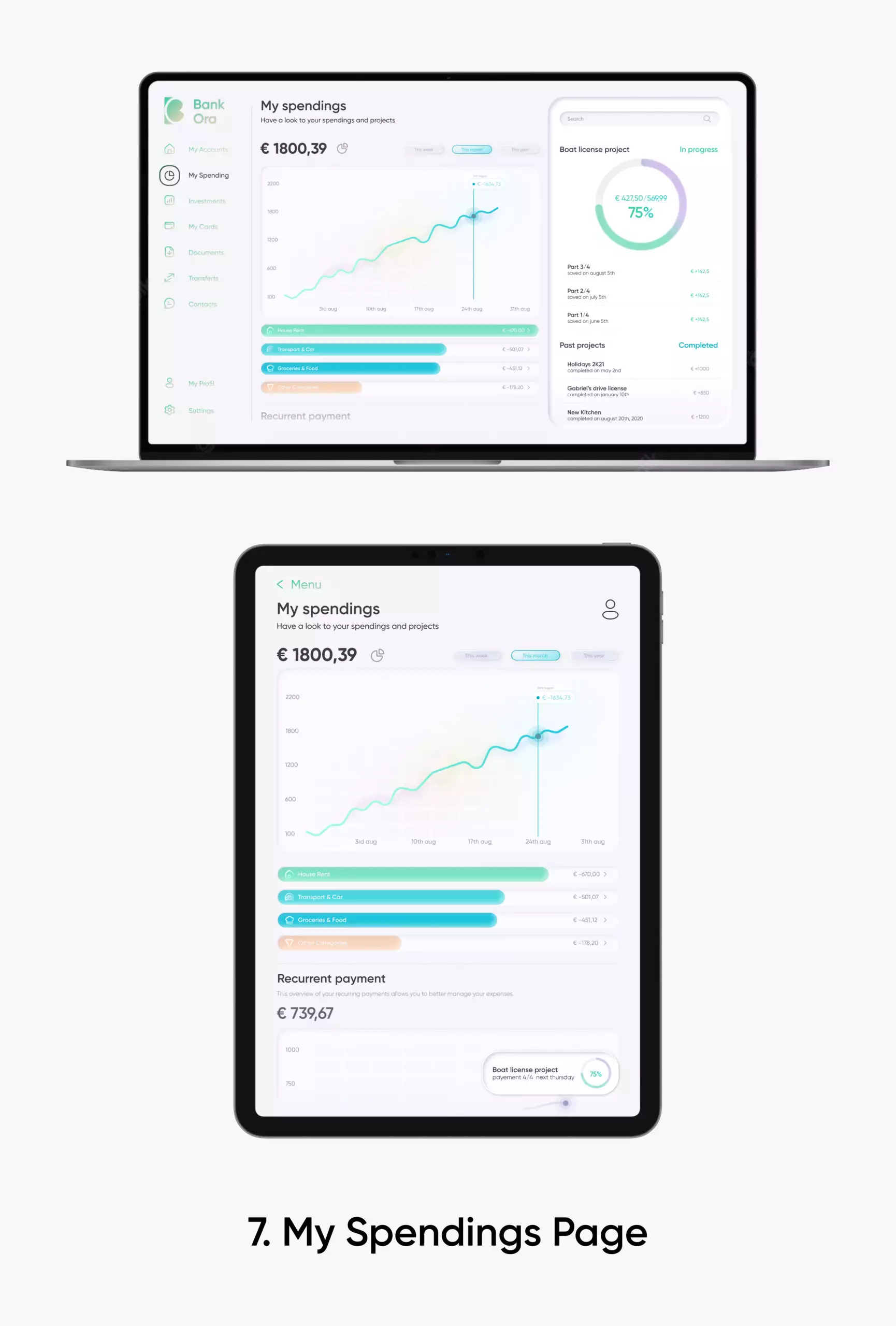

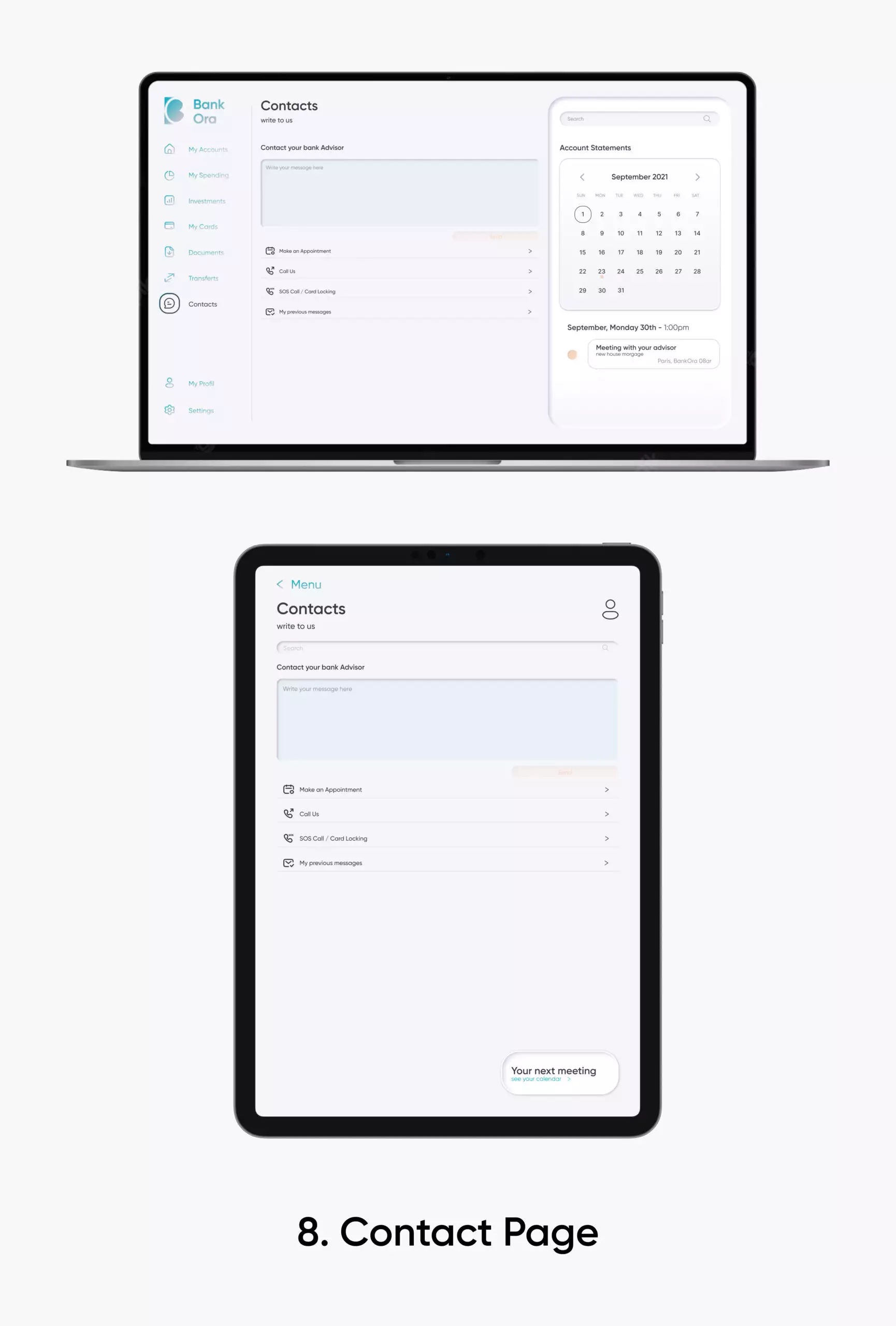

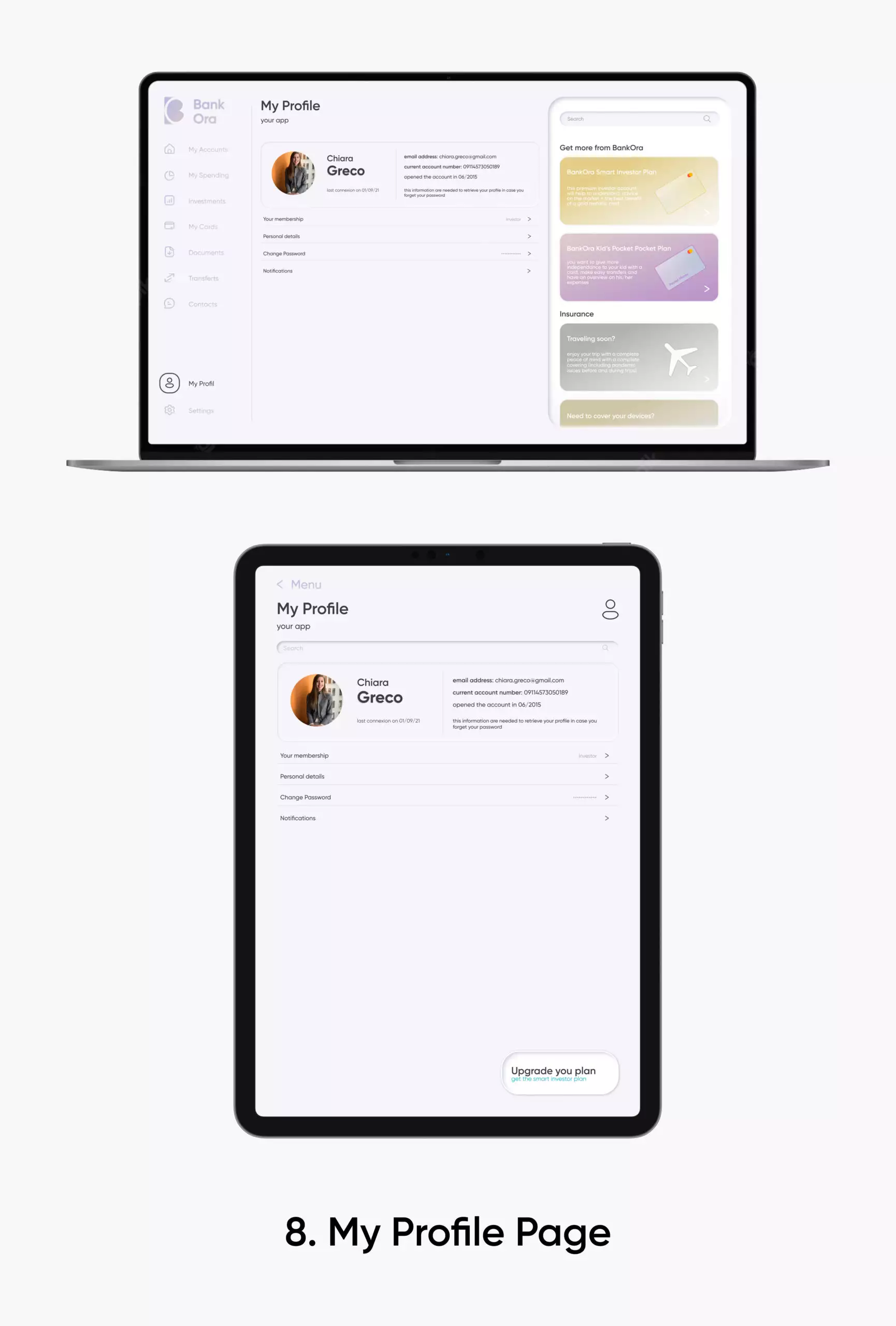

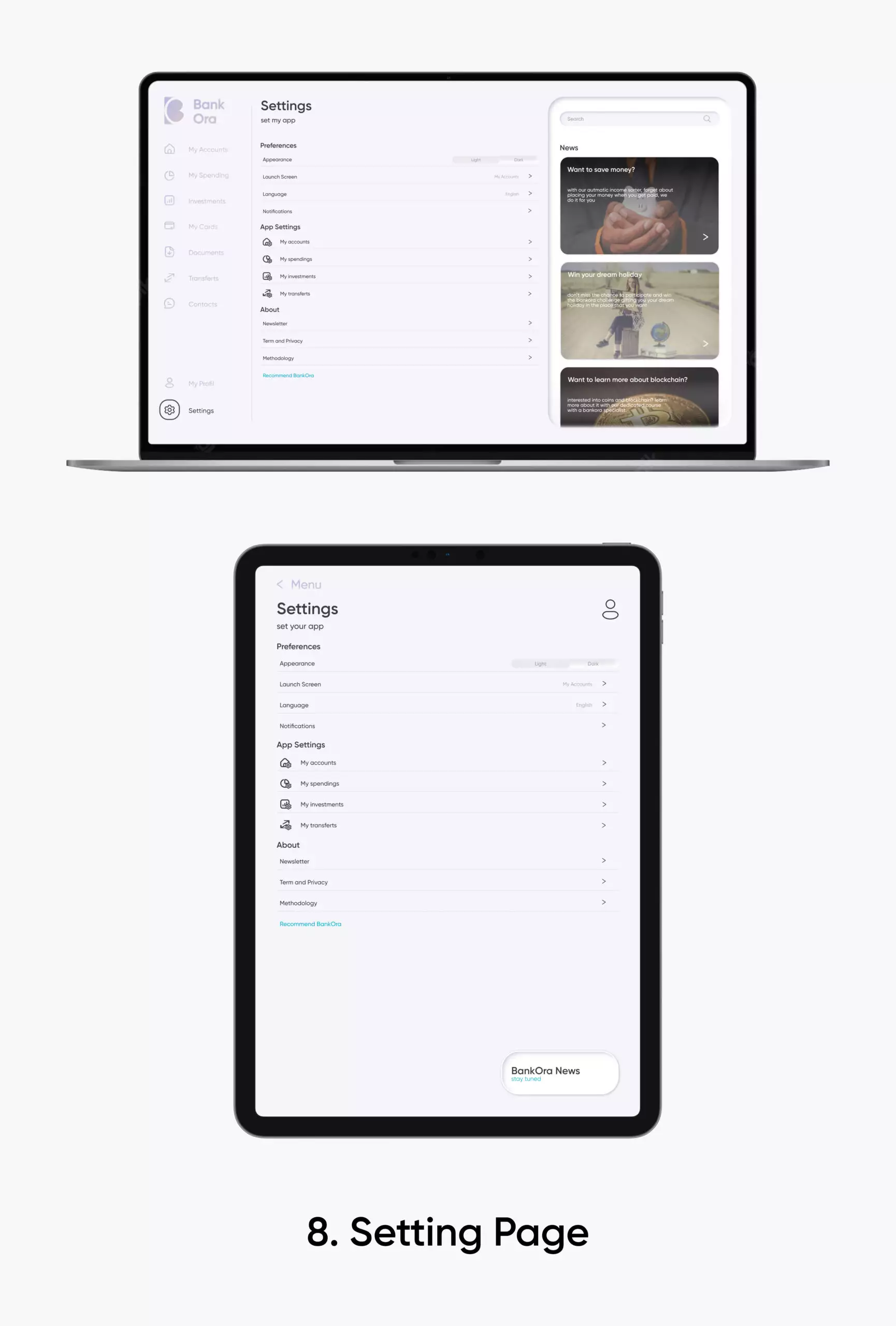

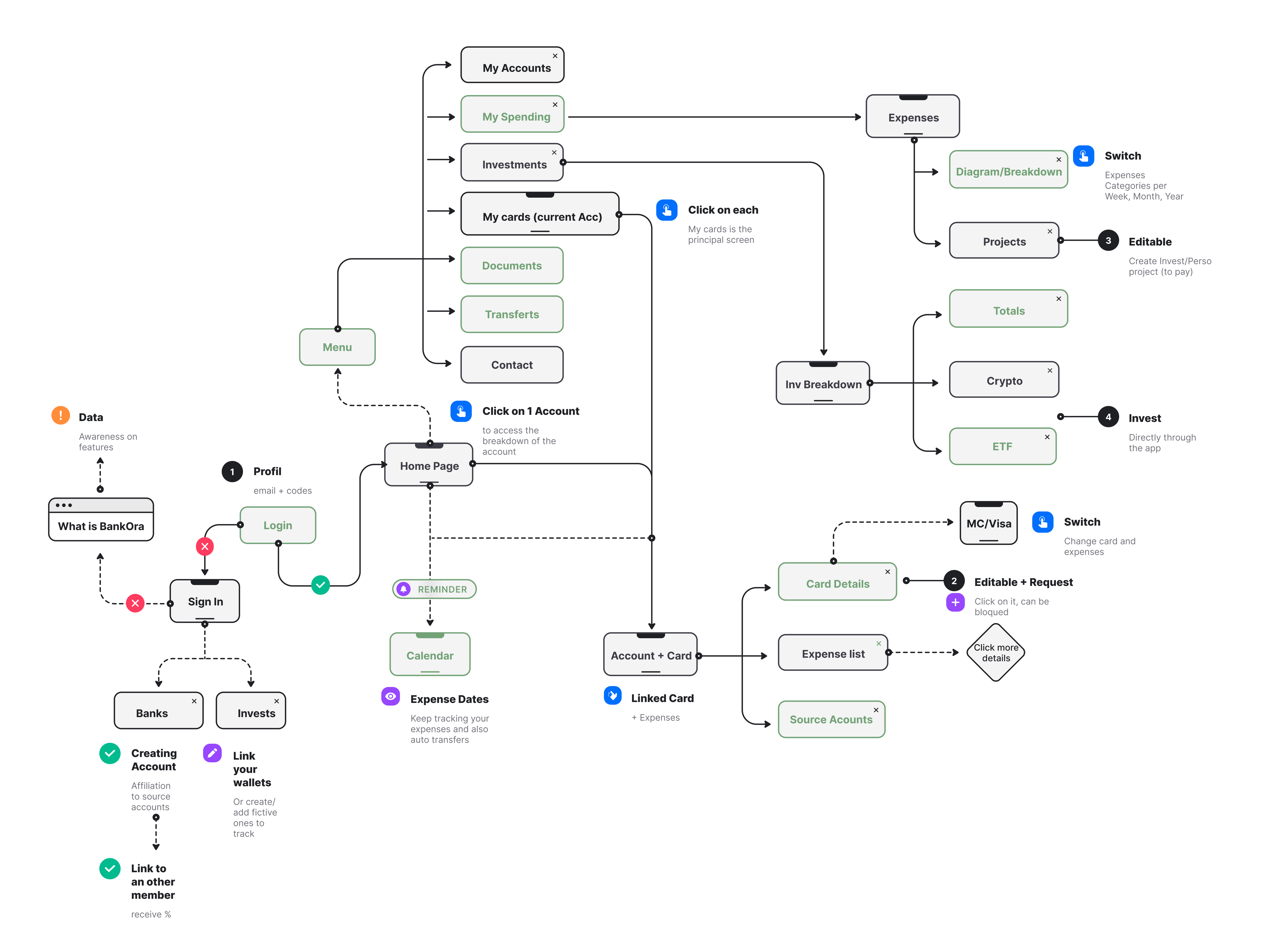

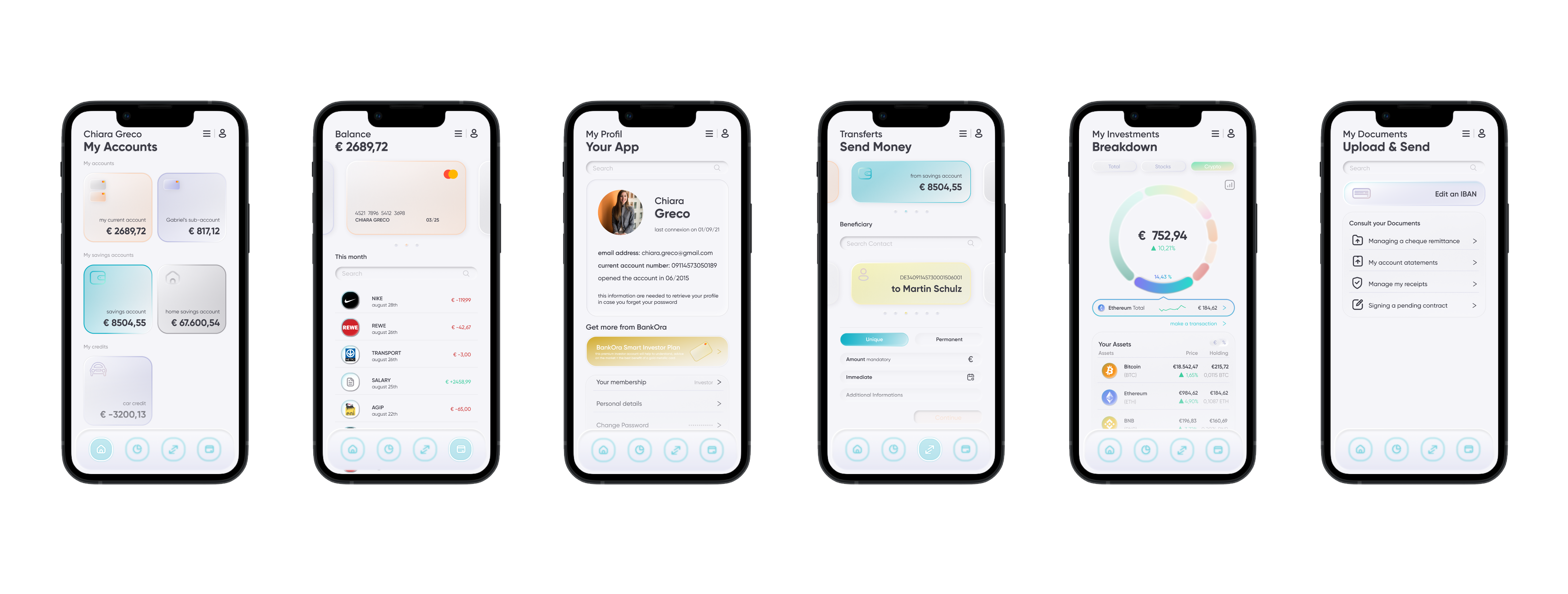

SCREEN PROTOTYPES

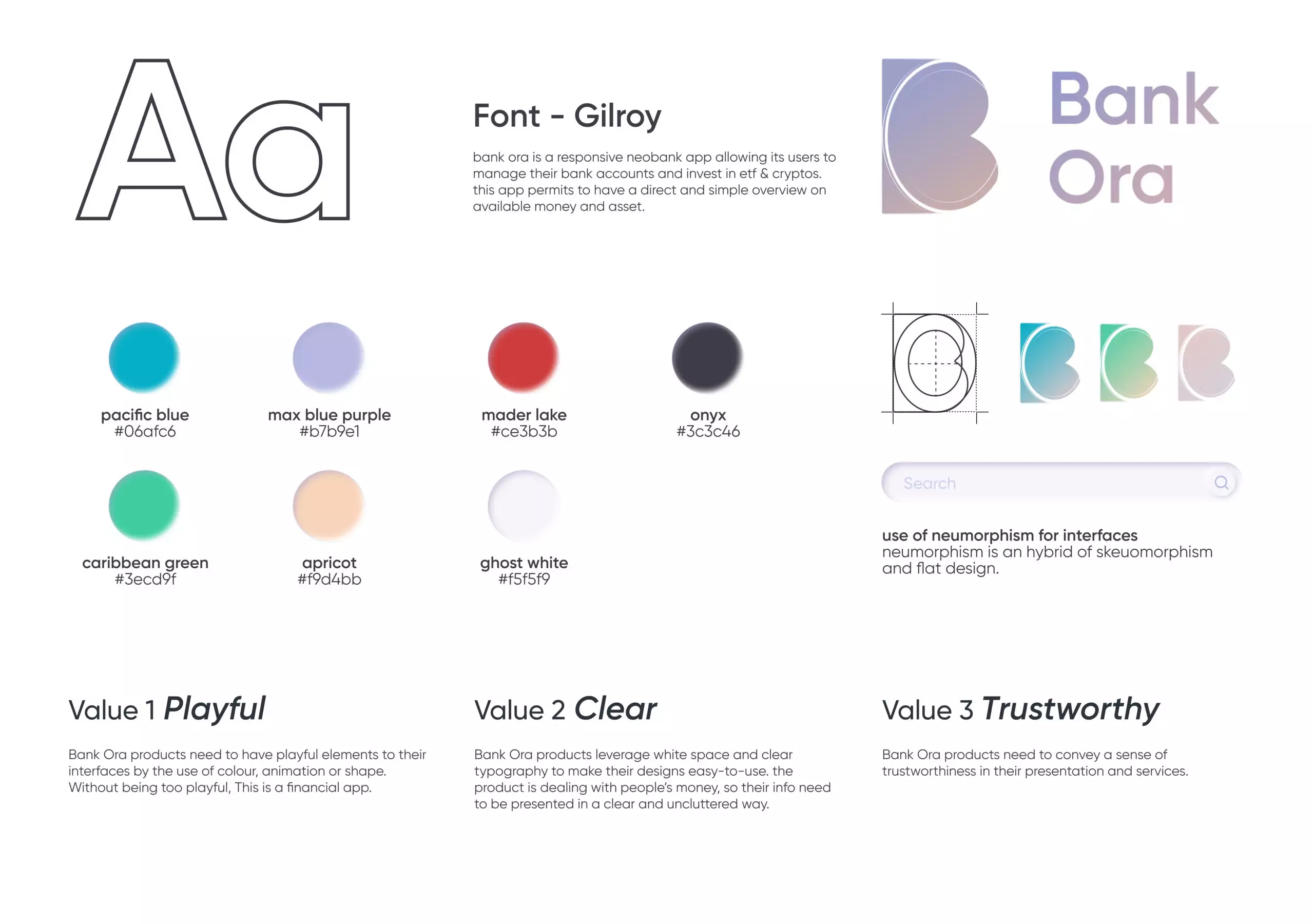

PRODUCT STYLE & VALUES

RESPONSIVE PRODUCT